Looking for predictable leads in the dynamic financial advisory industry requires more than market analysis and industry awareness. It demands a strategic shift. Despite meticulous efforts, professionals often see their content fail to generate leads. This article discusses financial advisor calculators, a powerful but often overlooked strategy.

These calculators boost visibility and engagement, offering a unique content marketing strategy. As we examine the transformative power of these tools, this guide shows how to use them to simplify complex financial concepts and increase backlinks. Join us as financial calculators become essential for producing quality leads and building a successful robo-advisory practice. In this article we will explore Top 12 Financial Advisor Cost Calculators In 2024.

The Power Of Financial Advisor Calculators

Financial advisor calculators transform content marketing and financial planning. These digital tools simplify complex financial concepts and make them accessible to a broader audience, not just number-crunching. Let's examine these calculators' strengths.

1. Simplifying Complexity:

Financial issues can be complicated for most people. Complex concepts are translated into simple interfaces by financial advisor calculators. These calculators simplify retirement planning, investment calculations, and mortgage options.

2. Enhancing User Engagement:

Interactive financial calculators increase user engagement. Unlike static content, calculators allow users to enter data and see personalized results. This dynamic interaction educates and engages users, encouraging them to explore other financial content.

3. Building Trust Through Transparency:

Practical financial advice requires transparency. Financial recommendation calculations and assumptions are transparent with calculators. User trust increases when they see the logic and methodology behind the results, strengthening financial advisor-client relationships.

4. Addressing Specific Needs:

Financial advisor calculators meet specific needs. Each calculator is helpful for retirement planning, investment analysis, or home affordability. This specificity ensures users receive targeted and relevant information, improving the financial advisory experience.

5. Boosting Backlink Potential:

Financial calculators can get more backlinks than other content for SEO. These calculators become valuable resources that other websites may link to when integrated into articles or blogs. This boosts search engine rankings and content reach across platforms.

6. Demonstrating Expertise:

Financial professionals demonstrate their Expertise through calculators. It is committed to offering practical tools to help people make financial decisions. Financial advisors stand out as experts in a competitive market.

7. Guiding Financial Conversations:

Financial calculators spark conversations. By presenting scenarios, these calculators encourage discussions about financial objectives, risk tolerance, and investment strategies. Financial advisors become integral participants in clients' financial journeys through interactive dialogue.

8. Adapting To Changing Needs:

Financial calculators adapt to changing economic conditions, making them versatile. These calculators can be updated to reflect changes in interest rates, tax regulations, and market conditions, keeping advice current.

Financial advisor calculators educate, engage, and empower people on their financial path, not just compute. These calculators enhance the financial advisory experience by simplifying complex concepts and building audience loyalty as part of a comprehensive content strategy.

Leveraging Calculators In The Right Way

The vast world of financial content creation relies on calculators. Some may worry about the high competition in this space, but using these tools properly is critical. This section discusses using financial advisor fee calculators to increase engagement, visibility, and lead generation. Financial calculator saturation, primarily online, is a common complaint. Calculator success depends on its presentation and usability as well as its existence. Calculators play specific roles in financial advisors' content strategies with a purpose-driven approach.

Calculators are plentiful, but strategic use keeps them effective. Consider the competition a chance to improve your strategy. You can rank higher in search results by aligning calculators with relevant topics. Common mistakes include making simple calculators or complex ones that overwhelm users. Achieving balance is crucial. The calculator should be easy to use and demonstrate the financial advisor's Expertise. A delicate balance ensures consumers find value without being overwhelmed.

Presentation is vital when embedding or building a calculator. Calculator aesthetics affect user engagement. An attractive design and valuable features improve user experience. Remember, a beautiful calculator encourages users to explore, increasing engagement. The goal is to avoid overwhelming users with information available elsewhere. Instead, use the calculator to access the financial advisor's Expertise. A custom or existing calculator should encourage users to seek further guidance, establishing the robo-advisor as a trusted source.

Calculators are SEO backlinks, not tools. Calculators connect information and action when seamlessly integrated into relevant content. Financial advisors can increase traffic by linking to these calculators from articles, blogs, and other content. Utilizing calculators depends on user engagement. If the calculator is helpful, easy to use, and informative, users will explore more content and seek professional help. User engagement turns a calculator into a lead-generating tool. Effective financial advisor calculator use requires strategy, presentation, and user-centric design. By following these principles, financial marketers may navigate the competitive landscape, improve their content marketing, and leave a lasting impression.

Individual Calculators And Their Applications

1. Retirement Calculator:

Financial planning for retirement is complicated, but the Retirement Calculator leads the way. This invaluable tool provides clarity for retirees and financial advisors. The Retirement Calculator simplifies the complicated process of calculating retirement savings. Its user-friendly interface makes it accessible to people of all financial backgrounds, making a daunting task manageable and empowering. A significant benefit of the Retirement Calculator is reducing retirement anxiety. This calculator helps many people plan for retirement financially. Users can see their financial trajectory by entering savings, expected expenses, and desired lifestyle.

This tool works well in retirement planning articles. The Retirement Calculator can be seamlessly integrated into a retirement anxiety blog post. The article can teach readers about proactive retirement planning and encourage them to use the calculator to manage their finances. Furthermore, the Retirement Calculator meets users' diverse needs. Whether starting a career or nearing retirement, the tool adapts. It encourages comprehensive retirement planning by considering inflation, healthcare fee structure, and investment returns. Like any tool, the Retirement Calculator has drawbacks. Consider these pros and cons:

Pros:

- Clarity and Confidence: The calculator gives people a clear financial picture and a retirement plan, instilling confidence.

- Individualized Guidance: Users receive tailored guidance based on income, expenses, and lifestyle.

- Strategic Planning: Financial advisors can use the Retirement Calculator to educate clients about proactive retirement planning.

- Versatility: The tool is suitable for a wide range of career stages.

Cons:

- Simplification Risk: Simplicity is a plus, but oversimplifying financial matters could lead to retirement planning mistakes.

- Assumption Dependency: Results depend on input data accuracy. Misleading projections can result from inaccurate assumptions.

- Emphasis on Numbers: Some users may neglect qualitative aspects of a fulfilling retirement in favor of numerical output.

2. Required Minimum Calculator

Understanding and following Required Minimum Distributions (RMDs) becomes crucial as people age. The Required Minimum Calculator is essential for those 70 and older with Traditional, Rollover, SEP, or SIMPLE IRAs. This calculator simplifies mandatory distribution regulations for individuals and financial robo-advisors, making it a valuable retirement planning tool.

Retirees find the Required Minimum Calculator helpful in simplifying a complicated process. The tool calculates the IRS-required annual withdrawal based on account balance, age, and life expectancy. This precision is essential to avoid penalties for not meeting mandatory distribution requirements.

One benefit of the Required Minimum Calculator is promoting compliance and financial responsibility. While RMDs may seem complicated, this tool simplifies the process. Users understand their obligations and can make informed retirement account decisions.

Financial advisors can learn from the Required Minimum Calculator. Traditional Advisors can explain RMDs to clients using this tool in articles or presentations. This strategic use strengthens the advisor's retirement planning expertise and encourages proactive client behavior. As with any financial tool, the Required Minimum Calculator has drawbacks. Consider these pros and cons:

Pros:

- Precision in Compliance: The calculator ensures RMD compliance, reducing penalties for non-compliance.

- Educational Value: Users, especially those unfamiliar with retirement regulations, learn about Required Minimum Distributions.

- Empowerment: The tool encourages financial responsibility by letting people plan their retirement.

- Showcase Financial Robo-Advisor Expertise: The Required Minimum Calculator allows advisors to help clients navigate complex retirement regulations.

Cons:

- Dependency on Accuracy: Calculator results depend on input data accuracy. Misinterpretations can result from inaccurate information.

- Oversimplification: While user-friendly, it may oversimplify retirement planning and overlook individual circumstances.

- Focus on Compliance: Users may overlook strategic financial planning by focusing on compliance.

Income Annuity Estimator:

The Income Annuity Estimator helps people plan for guaranteed retirement income in the complex world of retirement. This tool makes understanding and estimating income annuity easy with a user-friendly interface that reduces uncertainty. Financial professionals use the Income Annuity Estimator to help clients secure a guaranteed income stream.

Users can make informed financial decisions with this calculator, simplifying income annuities. The Income Annuity Estimator's main benefit is boosting retirement planners' confidence. Many struggle to maintain a steady income in retirement. Users can get a realistic income annuity estimate by entering their age, desired income, and other factors.

Strategically integrating the Income Annuity Estimator into content boosts its impact. Retirement income guarantees can be discussed in financial advisor blogs. Human Advisors empower readers to protect their finances with the Income Annuity Estimator.

The decision-making process can be overwhelming, but this calculator helps. Income annuities have payout options, contract conditions, and inflation protection. The Income Annuity Estimator minimizes these complexities so users understand their choices.

Pros:

- Financial confidence: The calculator gives retirees confidence by guaranteeing their income.

- Informed Decision-Making: The Income Annuity Estimator can be used by financial advisors to teach clients how important it is to make smart choices about their retirement income.

- Tailored Estimates: The tool lets users customize estimates to meet retirement goals.

Cons:

- Simplified Assumptions: The tool's simplicity can simplify some aspects, leading to misconceptions about income annuities.

- Dependency on Input Accuracy: Estimates depend on user input, and inaccurate data can give misleading projections.

- Focus on Quantitative Aspects: Users might emphasize numerical output and overlook qualitative aspects important to a comprehensive retirement plan.

Beneficiary RMD Calculator:

Understanding RMDs is crucial for inherited retirement accounts. The Beneficiary RMD Calculator is essential for beneficiaries to understand their annual withdrawal obligations. This calculator simplifies inherited IRAs and empowers individuals to make informed decisions, ensuring legal compliance and optimizing financial strategies.

In certain situations, the Beneficiary RMD Calculator estimates beneficiaries' annual withdrawals from inherited retirement accounts. RMD compliance is required for Traditional, Rollover, SEP, and SIMPLE IRA beneficiaries. The calculator factors in account balance, beneficiary age, and IRS life expectancy tables to estimate annual withdrawals accurately.

A significant benefit of the Beneficiary RMD Calculator is its ability to simplify inherited retirement accounts. Many must become more familiar with inherited IRA regulations, leading to mistakes and missed opportunities. Financial advisors can help beneficiaries meet legal requirements and optimize their financial plans by incorporating the calculator into educational content.

Consider a financial article on inheriting an IRA; the Beneficiary RMD Calculator can make theoretical concepts practical. By entering their information into the calculator, readers can better understand their RMD obligations and financial situation.

Pros:

- Legal Compliance: Helps beneficiaries avoid penalties and legal issues by following RMD regulations.

- Customized Estimates: Provides accurate estimates based on specific details.

- Education Tool: Helps beneficiaries understand inherited retirement planning.

- Strategic Integration: Financial advisors can use the calculator to educate clients and promote proactive inherited retirement account management.

Cons:

- Data Accuracy Dependency: Accurate and current input data is essential for accurate results.

- Singular Focus: The calculator works well for estimating RMDs but might not help with other parts of planning for an inherited retirement.

- Oversimplification: Oversimplifying inherited IRAs may lead to missed financial strategies.

College Savings Cost Calculator:

It can be hard to start saving for a child's education due to financial uncertainty. The College Savings Calculator helps people understand college savings planning. This calculator is helpful for parents, guardians, and students. Its primary purpose is to clarify higher education fees and savings contributions over hourly.

The user-friendly interface makes planning easy for people of all financial backgrounds. The College Savings Calculator helps clear up educational expense uncertainty. The calculator generates a roadmap based on the child's age, college choice, and expected annual tuition. This roadmap allows families to save prudently by outlining the required contributions.

Financial advisors can use the College Savings Calculator to write articles or blogs that help parents understand educational financial planning. The calculator can be seamlessly integrated into a piece on college savings stress to help readers visualize their savings paths.

The calculator also explains how different factors affect college savings. Users can change registered investment returns, monthly contributions, and college per year to test savings plan flexibility. This customization ensures the calculator meets each user's financial needs and goals.

Pros:

- Clarity and Planning: The calculator simplifies college savings planning by providing a clear roadmap.

- Customization: Users can tailor inputs to their circumstances and financial goals to create a savings plan.

- Accessible: The calculator's user-friendly interface promotes financial inclusivity in education planning.

- Strategic Content Integration: Financial advisors may utilize the calculator to teach clients about college savings.

Cons:

- A. Assumption Dependency: Projections depend on input data precision and assumptions about future tuition fee structure and investment returns.

- Overlooking Qualitative Aspects: The calculator may emphasize numerical factors, causing users to manage qualitative factors important to college selection.

- Complexity Perception: Despite efforts to simplify, the calculator may seem complicated to users unfamiliar with financial planning terminology.

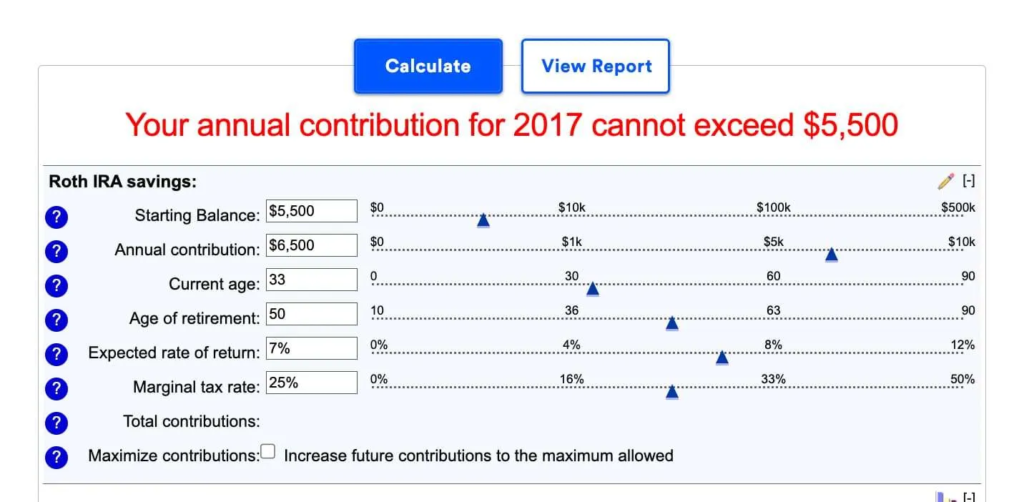

Roth IRA Conversion Calculator:

This financial decision to convert to a Roth IRA is crucial, and the Roth IRA Conversion Calculator guides you. This sophisticated tool helps people make informed decisions to ensure the conversion fits their financial situation and goals. The Roth IRA Conversion Calculator breaks down a complicated process into manageable steps. Its simple interface lets users enter traditional IRA balances, expected tax rates, and conversion amounts. This information is processed to project the financial effects of converting to a Roth IRA.

The Roth IRA Conversion Calculator's personalized insights are a significant benefit. Users' age, income, and retirement plans are considered in a customized analysis. Customization lets you gain a more nuanced understanding of Roth IRA conversion pros and cons. Financial advisors can educate clients by strategically integrating the Roth IRA Conversion Calculator into content. The calculator can seamlessly integrate into an article about Roth IRA conversion considerations. After exploring their scenarios, readers can better understand the financial implications and benefits of the conversion.

Pros:

- Informative Decision-Making: Users can see the potential outcomes of a Roth IRA conversion, helping them reach their financial goals.

- Personalized Analysis: The calculator uses individual variables and circumstances to ensure relevance to the user's financial situation.

- Strategic Content Integration: Financial advisors may employ the calculator to educate clients.

- Future Planning: Users can maximize Roth IRA conversion benefits by planning for their financial future and considering tax implications and retirement plans.

Cons:

- Assumption Dependency: Data precision determines accuracy. Incorrect tax rates or financial variable assumptions can cause inaccurate projections.

- Oversimplification Risk: While user-friendly, it may oversimplify tax planning and retirement strategies, missing essential details.

- Focus on Numbers: Consumers may only consider qualitative factors like lifestyle changes or future monetary requirements.

Investment Planning Calculator:

The Investment Planning Calculator helps people make wise investment decisions in the complex world of investments. This calculator allows people to create personalized investment strategies based on their financial goals, risk tolerance, and time horizon.

The Investment Planning Calculator, a virtual financial advisor, simplifies investment planning. Current savings, expected returns, and investment timeframe are entered. The calculator then generates projections to help users reach their financial goals visually.

The Investment Planning Calculator's customized guidance is a significant benefit. It takes into account individual circumstances and preferences. The calculator adapts to different investment philosophies, from novice investors seeking long-term growth to risk-averse individuals seeking capital preservation.

Financial advisors can use this calculator to teach. It makes abstract investment concepts relatable when embedded in content. An article on optimizing investment portfolios can seamlessly integrate the Investment Planning Calculator to demonstrate diversification and risk management.

Additionally, the calculator's versatility lets it serve investors at various stages. It explains investing to beginners. It becomes a strategic planner for seasoned investors, helping them adjust their investment strategies to changing goals and market conditions.

Pros:

- Customized investment management: Based on goals, risk tolerance, and timeframe.

- Educational Value: Teaches investment concepts and strategies.

- Visualization: Helps users understand and engage with investment plans with visual projections.

- Flexibility: Accepts novice and experienced investors' investment philosophies.

Cons:

- Assumption Dependency: Input data accuracy affects projection accuracy, which can affect outcomes.

- Simplified Models: The calculator may oversimplify market dynamics, setting unrealistic expectations.

- Market Volatility: Historical data, including unexpected market volatility, may affect long-term forecasts.

Retirement Planning Calculator:

Retirement planning requires careful planning and strategic decision-making. This process revolves around the Retirement Planning Calculator, a powerful financial planning tool. This calculator turns abstract goals into actionable steps for those seeking a customized retirement strategy.

The Retirement Planning Calculator helps you explore retirement options in depth. Unlike generic planning tools, this calculator considers current savings, expected expenses, and lifestyle preferences. This interactive tool enables you to build a secure and fulfilling retirement.

The wise application of the Retirement Planning Calculator goes beyond number crunching. Financial advisors can seamlessly integrate this tool into client interactions, promoting retirement planning collaboration. Advisors encourage clients to shape their financial futures by using the calculator.

A significant benefit of the Retirement Planning Calculator is its ability to simplify retirement decisions. Users can enter retirement age, lifestyle, and healthcare costs to receive a personalized retirement roadmap. This detail aids decision-making and reduces retirement planning uncertainties.

The Retirement Planning Calculator also educates. It can help financial advisors understand how variables affect retirement outcomes. Through interactive sessions, advisors can show how savings, investment, and retirement age changes can affect retirement finances.

Pros:

- Personalized Financial Roadmap: Customizes retirement plans to individual needs.

- Comprehensive Analysis: Considers inflation, healthcare costs, and lifestyle choices for a holistic retirement plan.

- Collaborative Decision-Making: Encourages financial advisors and clients to plan retirement actively.

- Educational Value: Let users explore how different variables affect retirement outcomes.

Cons:

- Assumption Dependency: The results' correctness depends on the input data's correctness. If assumptions are correct, it could lead to accurate projections.

- Quantitative Focus: The calculator excels at numerical analysis but may miss qualitative factors like emotional well-being and non-financial goals important to retirement.

- Risk of Oversimplification: While useful, the tool's simplicity risks simplifying retirement planning's Complexity.

Self-Employed Plan Contribution Calculator:

Self-employed people face unique retirement planning challenges. The Self-Employed Plan Contribution Calculator is essential to this financial journey. This calculator helps entrepreneurs determine how much to put toward retirement plans, ensuring financial security.

This simple but comprehensive tool simplifies self-employed retirement plan contribution calculations. Balancing current financial needs with retirement goals, entrepreneurs often wonder how much to contribute. The Self-Employed Plan Contribution Calculator simplifies and strategizes this challenge.

A significant benefit of this calculator is that it simplifies self-employed retirement contributions. Many entrepreneurs struggle with retirement planning, but this tool helps. Users can see their contribution goals by entering income, firm expenses, and retirement age.

When self-employed people are unsure how much to contribute to retirement plans, the Self-Employed Plan Contribution Calculator is invaluable. It facilitates informed decision-making by connecting financial goals to practical strategies. Financial advisors can strategically use this calculator to advise self-employed clients on retirement planning.

Pros:

- Customized Solutions: The calculator tailors solutions to self-employed people's finances.

- Empowerment: Users feel in charge of their lives when they choose how much to put into their retirement accounts.

- Strategic Financial Planning: Many financial advisors can help self-employed clients plan for retirement with the calculator.

- Clarity in Contributions: Entrepreneurs learn how much to contribute to meet their retirement goals and financial capacity.

Cons:

- Assumption Dependency: Calculations may affect projections based on input data accuracy.

- Oversimplification: While user-friendly, it may oversimplify self-employed retirement planning, overlooking important factors.

- Market Volatility Impact: Market volatility affects retirement contribution returns without explicit factoring.

Rent V Buy Calculator:

Renting or buying a home is a significant financial decision. The Rent v Buy Calculator guides people through this complex decision. In real estate, where financial implications are substantial, this calculator helps make informed decisions that align with short-term budget and long-term financial goals.

The Rent v Buy Calculator assesses the financial implications of moving from Rent to Buy. It considers Rent, mortgage payments, property taxes, and length of stay. The calculator helps people weigh each option's financial pros and cons by considering these factors.

One of the calculator's strengths is dispelling the myth that homeownership is always financially better. The calculator dispels misconceptions and encourages realistic homebuying and ownership fees may prompt users to enter accurate data.

Imagine someone considering a job change that may require relocation. This is where the Rent v Buy Calculator comes in handy. Users can enter their financial information, compare renting and buying annual fees in the prospective setting, and make a career- and financially-aligned decision.

Pros:

- Comprehensive Financial Comparison: The calculator breaks down mortgage payments, property taxes, and appreciation.

- Realistic Affordability Assessment: Users can make informed financial decisions by understanding the short- and long-term affordability of renting and buying.

- Flexible for Different Scenarios: The calculator adapts to job changes, relocations, and other life events to provide tailored insights.

- Myth Busting: Dispels the myth that homeownership is always financially better, encouraging users to consider their circumstances.

Cons:

- Market Volatility: Rapid property value or interest rate changes can affect the calculator's accuracy.

- Qualitative factors excluded: Lifestyle preferences and homeownership may not be fully covered, but financial aspects are.

- Assumption Dependency: The Rent vs. Buy Calculator needs correct information, like all financial tools. Misjudgments or overconfidence can skew results.

Home Affordability Calculator:

The dream of homeownership is universal, but financial details require precision. The Home Affordability Calculator helps people assess their readiness for this significant financial commitment. This tool calculates home ownership's economic feasibility and affordability, a long-held dream. Simply put, the Home Affordability Calculator simplifies the complex equation of income, expenses, and mortgage terms.

It considers current income, monthly debt, and desired down payment to assess a person's financial ability to buy a home. The Home Affordability Calculator simplifies the complex housing affordability process. Many people wonder if they can afford to move from renting to owning. Users can determine their home budget by entering financial information.

This tool works well in rent-versus-buy content. A blog post about the financial advantages of buying versus renting can easily incorporate the Home Affordability Calculator. Encourage readers to use the calculator to assess their financial situation and decide when to buy a home.

The Home Affordability Calculator also checks aspiring homeowners' reality. It makes users consider property taxes, homeowners insurance, and maintenance expenses in addition to the mortgage payment. This holistic approach informs people about homeownership's actual financial costs.

Pros:

- Financial Clarity: The calculator helps people make informed decisions about their homebuying ability.

- Holistic View: It considers various financial aspects, including down payment, monthly debt obligations, and additional homeownership costs, providing a comprehensive financial snapshot.

- Strategic Content Integration: Financial advisors can utilize the Home Affordability Calculator to help readers understand the financials of renting to own.

- Realistic Expectations: Users learn what homes they can afford, preventing financial strain.

Cons:

- Assumption Sensitivity: Calculations depend on input data accuracy, and small assumptions can cause significant discrepancies.

- Market Dynamics: The calculator estimates based on current market conditions, and real estate market fluctuations can affect projections.

- Quantitative Aspects: While important, the calculator may overlook qualitative factors that make homeownership satisfying.

Using A 401k For A Home Down Payment Calculator:

Using a 401k for a house down payment is a complicated financial choice, and the “Using a 401k for a Home Down Payment Calculator” is essential. This calculator helps people balance homeownership with long-term economic well-being by explaining the ramifications.

Users may enter their 401k balance, expected house purchase data, and future contributions into this calculator. The program analyzes this data to see whether 401k savings may be used for a property down payment. One benefit of the “Using a 401k for a Home Down Payment Calculator” is openness.

Users may make educated choices by seeing the possible effects on retirement Mutual funds. Transparency helps people avoid rash financial decisions. Financial advisers might strategically include this calculator in articles on utilizing retirement savings to buy a property.

This type of advisor helps customers evaluate trade-offs and make long-term choices by using the calculator. Calculators are also educational. Users should consider tax ramifications, early withdrawal penalties, and the retirement nest egg effect. This educational element promotes a holistic approach to financial decision-making and a better knowledge of how financial decisions are interrelated.

Pros:

- Instant Homeownership: Using a 401k for a down payment helps people to become homeowners faster than with typical savings.

- Asset Diversification: Homeownership may complement other financial portfolio assets.

- Flexible Repayment: Some employer-sponsored plans let members reimburse withdrawn amounts, allowing retirement savings management.

- Low-Interest Borrowing: 401k home down payment loans may have lower interest rates than regular loans.

Cons:

- Retirement Savings: Withdrawing from a 401k reduces retirement savings, which may compromise financial stability.

- Taxes: Different plans may tax withdrawals, decreasing the net amount for a house down payment.

- Early Withdrawal Penalties: Withdrawing from a 401k before 59½ due to penalties may increase the cost of utilizing these assets.

- Missed Investment Growth: Withdrawing 401k funds reduces overall retirement portfolio value.

FAQs

What Is The Purpose Of Financial Advisor Calculators?

Financial advisor calculators provide a unique content marketing approach by simplifying complex economic ideas, increasing user engagement, building trust via transparency, and meeting individual financial demands.

How Do Financial Calculators Boost User Engagement?

Interactive financial calculators educate and engage users by letting them enter data and get tailored results, encouraging them to explore more financial material.

Can Financial Advisor Calculators Help In Building Trust With Clients?

Financial adviser calculators disclose calculating assumptions and methods, promoting openness. Transparency helps users trust outcomes by explaining their reasoning.

What Specific Financial Needs Do Financial Advisor Calculators Address?

Calculators for financial advisors include retirement planning, investment analysis, housing affordability, and more. Calculators give focused and relevant information, boosting financial advice services.

How Do Financial Calculators Contribute To SEO and Backlink Potential?

Other websites may link to financial calculators in articles or blogs. This improves SEO and content reach across platforms.

How Can Financial Professionals Demonstrate Their Expertise Through Calculators?

Calculators may demonstrate financial professionals' dedication to providing valuable tools to assist consumers in making educated financial choices.

How Do Financial Calculators Contribute To Guiding Financial Conversations?

Financial calculators prompt talk about financial goals, risk tolerance, and investment strategies, making financial advisers essential to customers' financial journeys.

Are Financial Calculators Adaptable To Changing Economic Conditions?

Financial calculators may be updated to reflect interest rates, tax restrictions, and market situations, keeping advice current.

What Common Mistakes Should Be Avoided When Using Financial Calculators?

Calculators that are too basic or overpowering are common blunders. Balance is vital to being user-friendly and demonstrating the human advisor's knowledge.

How Can Financial Advisors Effectively Leverage Calculators To Generate Leads?

Financial advisers might deliberately use calculators in material to rank better in search results. Calculators boost user engagement and lead generation.

Conclusion

The journey to financial success involves strategic content creation and leveraging the power of financial advisor charge. By understanding the nuances of each calculator and presenting them effectively, financial professionals can enhance their content and generate a steady stream of quality leads. The path to success lies in purpose-driven content, engaging calculators, and a commitment to providing value in every aspect of the financial advisory journey.

If you want to make passive income then click on the link = click here